401k Limits 2024 Employer Match Limit

401k Limits 2024 Employer Match Limit. So, owners of these roth 401 (k) accounts no longer have to take rmds. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit will go up to.

Workplace retirement plan contribution limits for 2024. Your employer match will only be $17,500, though, instead of the full $25,000, or 5%.

401k Limits 2024 Employer Match Limit Images References :

Source: noelvkarisa.pages.dev

Source: noelvkarisa.pages.dev

401k Contribution Limit 2024 Employer Match Livvy Tildie, The internal revenue service (irs) does limit the contributions.

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png) Source: seliebolivette.pages.dev

Source: seliebolivette.pages.dev

Contribution Limit 401k 2024 Employer Match Aimil Auberta, Learn how to make the most of your 401(k) plan

Source: rikkiybenoite.pages.dev

Source: rikkiybenoite.pages.dev

2024 401k Limits Chart Employer Match Fleur Nadiya, Your employer's matching contributions don't count toward your contribution limit if you participate in a 401 (k) plan.

Source: roxyyvivian.pages.dev

Source: roxyyvivian.pages.dev

2024 401k Contribution Limits 2024 Employer Match Bobby Christa, The 2024 contribution limit for 401 (k) plans is $23,000, or $30,500 for those 50 and older.

Source: rikkiybenoite.pages.dev

Source: rikkiybenoite.pages.dev

2024 401k Limits Chart Employer Match Fleur Nadiya, Workplace retirement plan contribution limits for 2024.

Source: janetblauraine.pages.dev

Source: janetblauraine.pages.dev

2024 Max 401k Contribution Employer Contribution Limits Jody Rosina, So, owners of these roth 401 (k) accounts no longer have to take rmds.

Source: athenabgerhardine.pages.dev

Source: athenabgerhardine.pages.dev

Limit For 401k Contribution 2024 Employer Match Midge Susette, Most people don't max out their 401(k).

Source: seliebolivette.pages.dev

Source: seliebolivette.pages.dev

Contribution Limit 401k 2024 Employer Match Aimil Auberta, What makes 401(k) plans especially attractive is that your employer can match your contributions (up to set limits).

Source: dareenvdelcina.pages.dev

Source: dareenvdelcina.pages.dev

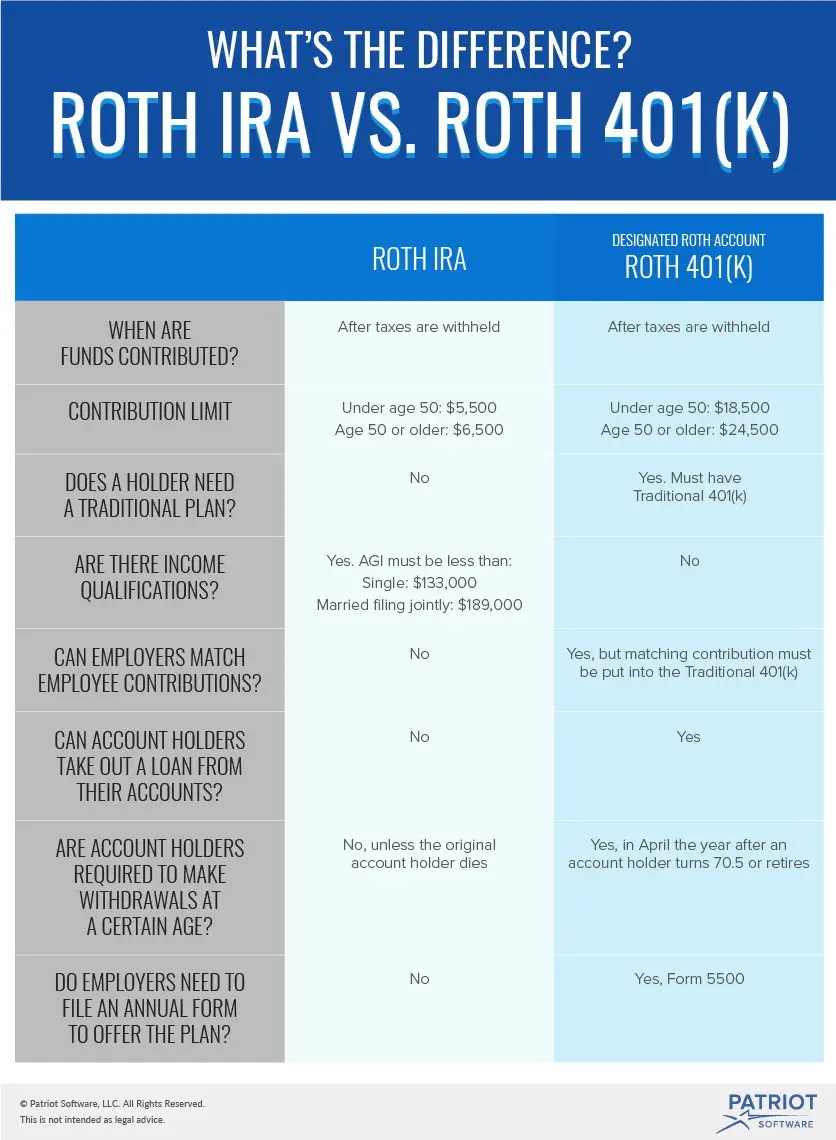

Roth 401 K Limits 2024 Employer Match Roxi Wendie, You can ask your employer if they offer an employer.

Source: sheilahwdolly.pages.dev

Source: sheilahwdolly.pages.dev

401k Limit 2024 Combined Employer Match Berte Celisse, By allowing the business owner to contribute as both the employee and employer by way of employee salary deferrals of up to $23,000 (or $30,500 if participant is 50 or older for.

Category: 2024