Gift Tax 2024 Limit

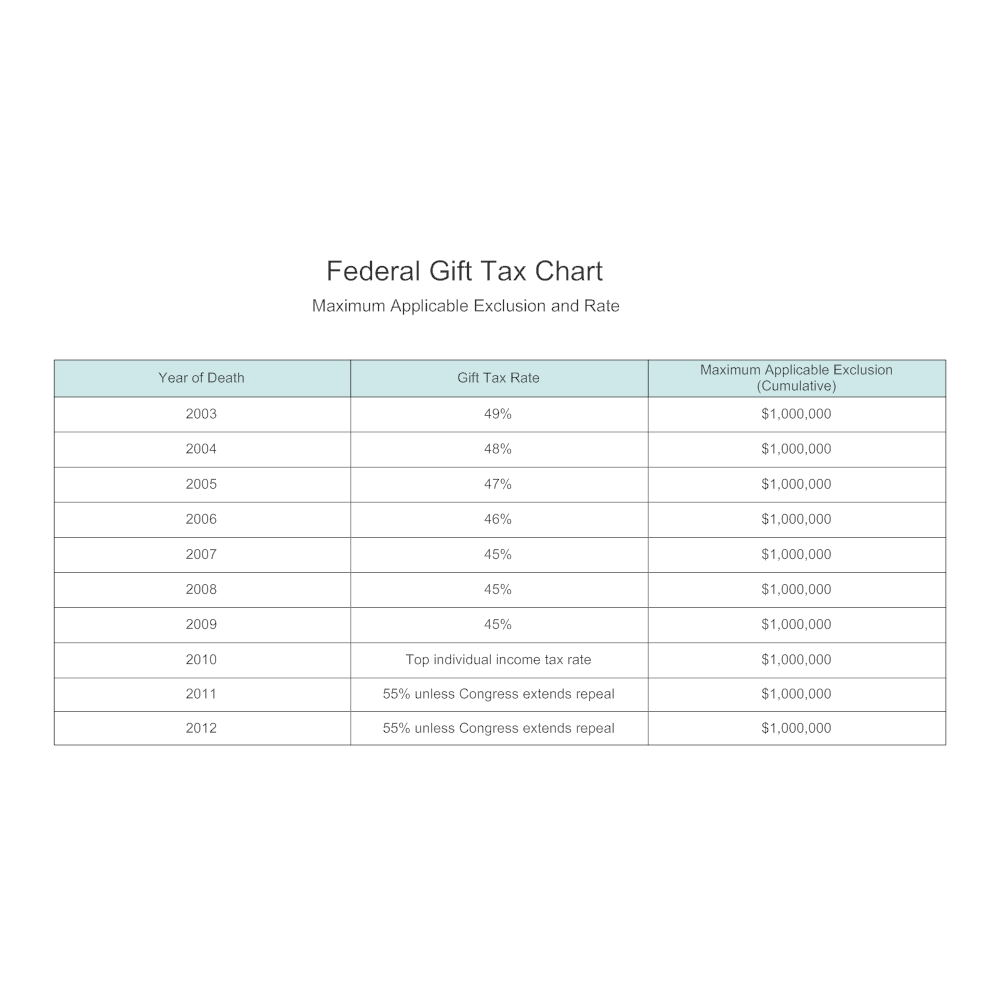

Gift Tax 2024 Limit. 11 rows — — the income tax act states that gifts whose value exceeds. 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000.

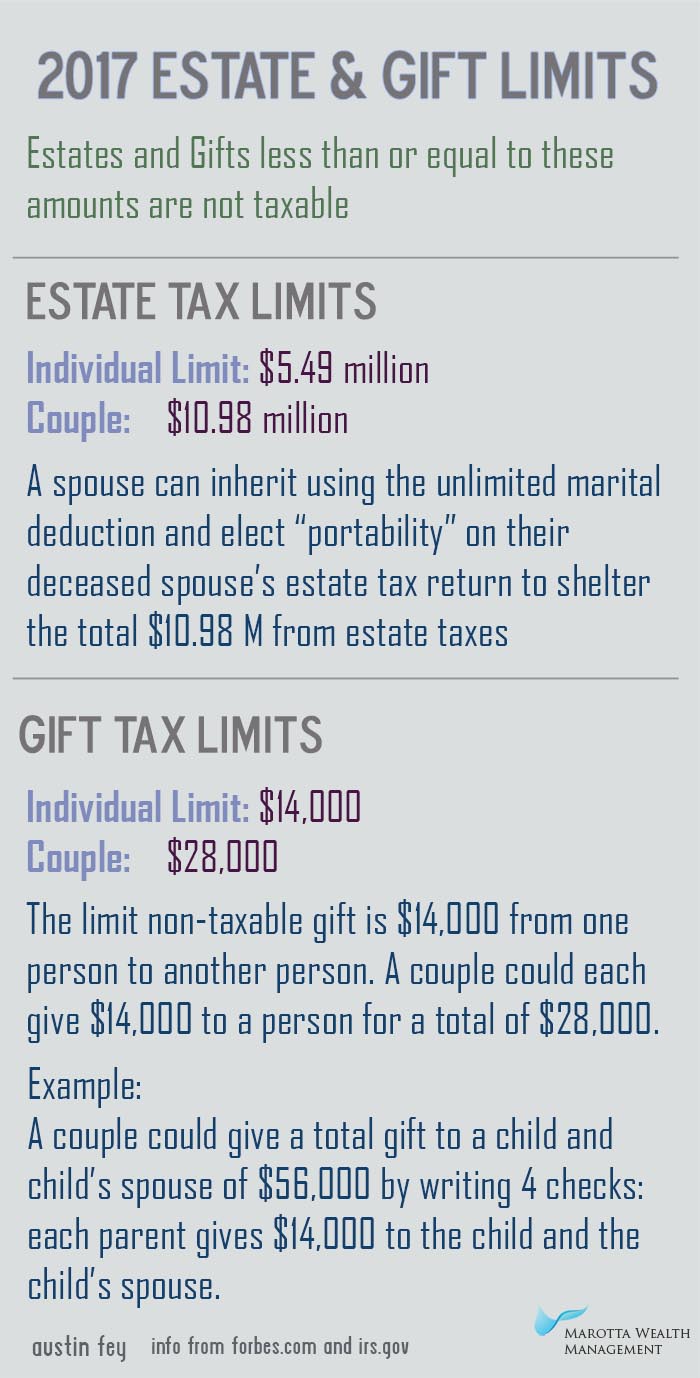

— for 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023. A married couple filing jointly can double this amount and gift.

Gift Tax 2024 Limit Images References :

Source: metasusann.pages.dev

Source: metasusann.pages.dev

What Is The Gift Tax Limit For 2024 And 2024 Helen Kristen, — the 2024 gift tax limit is $18,000, up from $17,000 in 2023.

Source: www.financestrategists.com

Source: www.financestrategists.com

Gift Tax Limit 2024 Calculation, Filing, and How to Avoid Gift Tax, 11 rows — — the income tax act states that gifts whose value exceeds.

Source: cwccareers.in

Source: cwccareers.in

Gift Tax Limit 2024 Exemptions, Gift Tax Rates & Limits Explained, Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Source: kaiemmaline.pages.dev

Source: kaiemmaline.pages.dev

Gift Tax 2024 Limit Ivette Sabrina, Starting on january 1, 2024, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2023).

Source: newsd.in

Source: newsd.in

IRS Gift Limit 2024 All you need to know about Gift Limit for Spouse, — the gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: aureleawkaryl.pages.dev

Source: aureleawkaryl.pages.dev

Annual Gift Tax Limit 2024 Cayla Nannie, For example, a man could.

Source: caryqemelina.pages.dev

Source: caryqemelina.pages.dev

Annual Gift Tax Limit 2024 Aleda Aundrea, — the united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2024.

Source: wylmaqelisabetta.pages.dev

Source: wylmaqelisabetta.pages.dev

Gift Limit Tax 2024 Evonne Thekla, — gifts upto rs 50,000 per annum are exempt from tax in india.

Source: vinitawsophi.pages.dev

Source: vinitawsophi.pages.dev

Estate Gifting Limits 2024 Toma Kittie, As discussed, in a situation where the gift donor and receiver are not related to one another, the maximum amount they can transfer is rs.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

What Is the 2023 and 2024 Gift Tax Limit? Ramsey, 2024 — crowdfunding distributions may be includible in the gross income of the person receiving them depending on the facts and circumstances.

Posted in 2024